The best business model to reduce administrative expenses with the practicality of a digital platform.

INTEGRATION DOCUMENTS

As an Individual with business activity

- Official Identification

- Proof of updated fiscal situation

- Updated proof of address

- Bank statement where updated ‘clabe’ appears

- CURP

- Telephone

As a Moral person

- Articles of association

- Power of Attorney where the legal proxies appear with act of dominion. (or equivalent) (if applicable)

- Proof of updated fiscal situation

- Updated proof of address

- From the legal representatives:

- Official Identification

- CURP

- Telephone

For Foreigners

- Articles of association (or its equivalent)

- Power of Attorney where the legal proxies appear with act of dominion. (or equivalent) (if applicable)

- Tax Id (or its equivalent)

- Updated proof of address

- From the legal representatives

- Passport

- Telephone

BENEFITS

Objectives of and Integradora Company

- Increase the bargaining power of micro, small and medium-sized enterprises in the supply, marketing, financial and technological markets, among others.

- Consolidate its presence in the domestic market and increase its participation in the export market.

- Promote the specialization of associated companies in products and processes that have comparative advantages.

Benefits

- It raises the competitiveness of the associated companies.

- It creates economies of scale for its associates, derived from a greater bargaining power to buy, produce and sell.

- Access to specialized services is facilitated at low cost since these are paid in a common way among the associates.

- It avoids the duplication of investments, being able to acquire fixed assets in the name and account of its associates and in a common way, including renewing or innovating machinery and equipment.

- It promotes the specialization of partners in certain processes and products with comparative advantages.

- It favors competition to wider markets by consolidating the production of its associates.

- The entrepreneurs are dedicated to producing, while the integradora company is responsible for carrying out specialized procedures and activities required by the associates.

- It maintains the individuality of entrepreneurs in the internal decisions of their companies.

- This form of business organization has the flexibility to adapt to any economic activity.

Limits

- They cannot be partners of an integradora company, those natural or legal persons that are not formally constituted.

- The integradora company acts exclusively on behalf of its partners; therefore, it is only your representative to customers and suppliers.

- It cannot carry out any part of the production process that involves the activity of its associates.

- The assets that are acquired for the productive process of the partners, cannot be owned by the integradora, since it is the partners who carry out the activity of producing and therefore, are the owners of the machinery and equipment.

- It is not allowed to set up integradora companies with entrepreneurs who carry out unfair practices or have monopolistic activities or whose activity leads them to these situations.

¿How does Third Party Billing (Clients) operate between an integrated partner and the Integradora?

- Integrated Partners

- They ask the Integradora Company for the consolidated sale of their products.

- Integradora Company

- Makes a Consignment Agreement with its partners for sales operation.

- It issues an invoice to the client in the name and account of its integrated partners.

- Customers

- Receives invoice and merchandise from the Integradora Company.

- Pays to the Integradora Company

- Integradora Company

- Receives the amount of the sale

- Provides each Partner with a list of the operations carried out to his account and mandate and gives him a copy of the invoice issued to the client.

- Liquidates each partner's share of the sale.

- Collects his fees

- Pays its taxes according to its corporate purpose.

- Integrated Partners

- Receive from the Integrating Company the amount of the sales of its products and services.

- They pay the company the commission for the sales made in their name.

- Each partner pays its taxes in accordance with its corporate purpose.

¿How does payment to third parties (Suppliers) operate between an Integrated Partner and the Integradora?

- Integrated Partners

- They request the Integradora Company to jointly purchase their products.

- Integradora Company

- Makes a Consignment Agreement with its partners for the purchase of materials and supplies.

- Requests contributions from the partners for the purchase.

- Receives invoice in the name and account of its partners.

- Supplier

- Delivers the products to the Integradora.

- The Integradora Company pays the supplier.

- Gives invoice of purchase of the goods to the Integradora.

- Integradora Company

- Receives the goods and distributes them

- Provides each partner with a list of the operations carried out to his account and mandate and gives him a copy of the invoice received from the supplier.

- Collects his fees

- Pays its taxes according to its corporate purpose

- Integrated Partners

- Receives the merchandise and its vouchers

- Pay the Integradora Company

- Each partner pays its taxes in accordance with its corporate purpose.

FREQUENTLY ASKED QUESTIONS

What is an Integradora Company?

It is a form of business organization that associates individuals or legal entities, Mexican or foreign, of micro, small and medium scale (SMEs) formally constituted. Its corporate purpose is to provide specialized services to its partners, such as:

- Manage financing.

- Joint purchase of raw materials and inputs.

- Selling production in a consolidated manner.

Through these association schemes, SMEs increase their competitiveness.

What is the justification for the creation of Integradora Companies?

Considering that the grouping of companies contributes to the integration of productive chains to improve competitiveness, the Integradora Companies were created by a Presidential Decree of Carlos Salinas de Gortari in 1993, which underwent modifications (expansion of powers) in 1995 by decree of President Ernesto Zedillo.

How does an Integradora work or operate?

It acts as Representative and Mandatory of the Partners (clients) grouped together to sign contracts, issue invoices, receive invoice collections, issue payments, among others.

Why are integrated companies considered partners and not clients?

Because the decrees that regulate us estipulate that to make use of our services, "clients" must be members of the Integradora.

Who can be a partner of the Integradora Administra tu Negocio?

Individuals and/or legal entities, Mexican and/or foreign, that need to group together for a specific purpose.

Can a foreigner become a member of the Integradora Administra tu Negocio?

Yes, the Integradora companies have the capacity to represent foreigners (individuals or legal entities) in Mexican territory without the need to be incorporated in Mexico or require a tax id for their operations, these actions are of high value for foreign trade operations.

What are the advantages of a foreigner (individual and/or legal entity) being represented by Integradora Administra tu Negocio?

- You can start operations in 48 hours once the contracts are signed, since incorporating a company in Mexico can take at least 4 months.

- At the time of dissolving a company, instead of taking 18 months, it would take an average of 72 hours being a partner of the Integradora.

What are the obligations or what does the Integradora commit to its partners?

To carry out in accordance with the law, each one of the mandates, as well as to render accounts in due time and form.

As a partner of the Integradora Administra tu Negocio, how do I know where my money is?

The money of our partners is kept in concentrator accounts in the name of the integradora, opened in banks within the national territory. Likewise, each partner has its own sub-account, which is available 24/7 within the Administra tu Negocio web system, for real-time consultation.

When in the Partner's opinion it is necessary, the bank accounts for the mandates may be joint between the Partner and the Integradora Company.

Is it mandatory for an Integradora Company to have a contract of internal agreements that will govern the activities of the partners?

Yes, our form of integration and operation is set forth in the articles of incorporation.

Legal basis: General Law of Mercantile Corporations.

Once I am a partner of the Integradora, am I obliged to carry out all my operations through it?

Not necessarily, once you are a partner of the Integradora Administra tu Negocio, you and/or your company will be able to carry out only and only the operations that you consider.

Legally, what is an Integradora Company authorized to do?

- To represent legally

- To bill and collect accounts

- To pay accounts

- To finance

The above, by order and legitimate and statutory mandate in the name, account, and representation of our integrated partners.

How much does it cost to become a member?

The cost of the action to become a member has a representative cost of 1 Mexican peso, once you are a member of the integradora, you only pay a commission for the money managed through it, without the need of fixed fees or charges for account management, that is, only pay per use, without penalties for not using it.

Do I have to declare to my clients at a contract signing that I am a member of the Integradora?

Yes, it is the best thing to do; so that there is no fraud, or the client is not surprised to receive an invoice from the Integradora. With the following statement it is understood that the Integradora is an agent of the Integrated Partner. Many times, the client will ask for the general data of the Integradora in order to include it in its Suppliers' catalog.

Who is responsible for the provision of the service or the seller of the product?

The responsible party is the Integrated Partner because the Integradora is a statutory mandatory. The integradora only represents you for billing and collection purposes.

What elements must an invoice issued by the Integradora on behalf of its partners include?

It is obliged that the invoice issued must include the "Third Party Concept Complement" that the SAT publishes in its website".

Based on the RMF 2019 in rule 2.7.1.3.

What is the company name of the Integradora and why?

Integradora, Labor y Transporte S.A. de C.V., since at the beginning the Integradora provided services to groups of land transportation drivers.

Does the Integradora replace the work of an accountant?

No, the Integradora works hand in hand with the accountants of each person, whether individual or legal entity, to achieve an optimal management of the treasury of our partners.

What is a grouping model within an Integradora Company?

The Integradora Administra tu Negocio offers to all its partners, whether they are individuals and/or legal entities, the option of grouping among themselves for a specific purpose, such as the incursion into a new business, a short-term business or for those projects that are eventual.

What is the difference between Administra tu Negocio and other Integradora Companies?

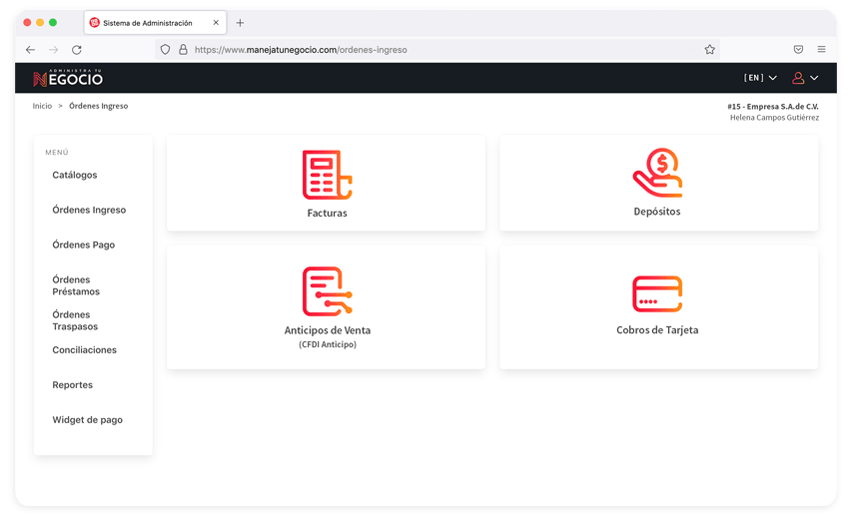

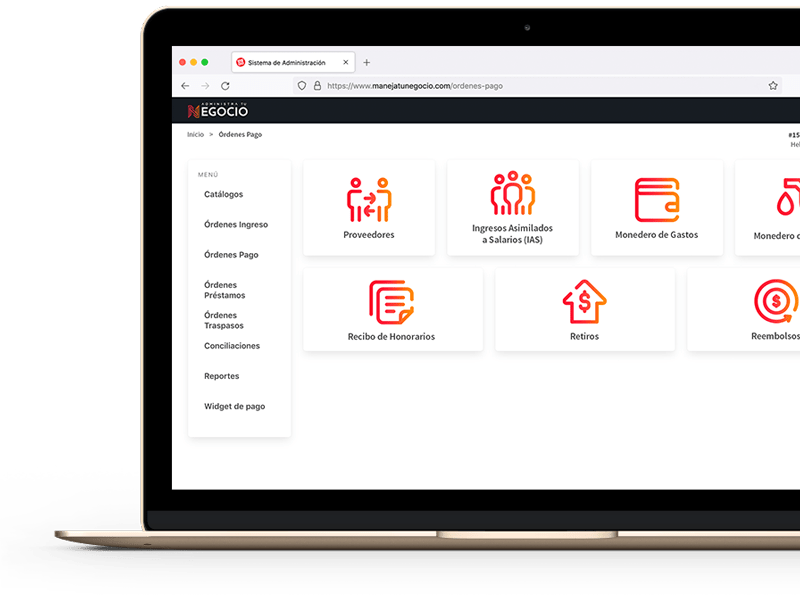

Administra tu Negocio, an Integrating Company specialized in treasury management, has its own web-based system that is easy to use and available 24/7 for all our partners, in addition to:

- Support and customer service from Monday to Friday from 9:30 am to 6:30 pm. GMT-6

- Free advice on administration, treasury, legal, fiscal, and foreign trade frameworks required by your business.

- Increase of operative flow

- Legal representation capacity to sign contracts, negotiations with third parties, contracting, among others.

What are the collection methods that my clients can use to make payments to me through the Integradora?

Our Integradora Administra tu Negocio, offers to all our partners the Referenced Collection, simplifying the bank reconciliation, the following is a list of the different means of collection in Mexican pesos available:

- SPEI (You have an account clabe for each one of your clients).

- CIE Agreement in BBVA and Santander (You get a reference for each collection you want to obtain).

- Charges with Cards

- Bank Terminal.

- Remote Collection.

- Accepts MSI

- Subscriptions

- Collections at Oxxo

Likewise, our members who need to make payments in U.S. dollars can use the following means:

- SPID (System of Interbank Payments in US Dollars between Mexican accounts).

- SWIFT CODE (Bank identification code most used for international money transfers).

- Card Collections

- Remote payments.

- Subscriptions

Once I am a member of Administra tu Negocio Integradora, can I integrate the payment methods to my website or current systems?

Yes, through payment buttons (WIDGETS) and/or by API.

What types of payments can the Integradora make by mandate of its members?

Any type of payment to your beneficiaries, either in Mexico or abroad, the most common being payments to:

- Suppliers

- Collaborators

- Reimbursement of expenses

- Credit to gasoline and expense wallets

- Payment of taxes, duties and benefits

- Services

In addition, you can withdraw to the bank account of your company or business.

What currencies can I handle as a member of Administra tu Negocio?

We have concentrator accounts in Mexican pesos (MXN) and US dollars (USD) and each member can decide when to exchange it and how long to keep it there.

What exchange rate does Administra tu Negocio operate with?

With the bank exchange rate, updated at the moment of your operation.